What will happen to my Intraday position if the stock hits the circuit limit?

Intraday trading allows you to leverage positions and buy or sell stocks up to five times your account balance. However, these positions must be squared off within the same trading day. If they aren’t, they’ll be squared off by FYERS at 3:15 PM. Sometimes, stocks hit their circuit limits (either upper or lower), temporarily halting further trading at the defined price range.

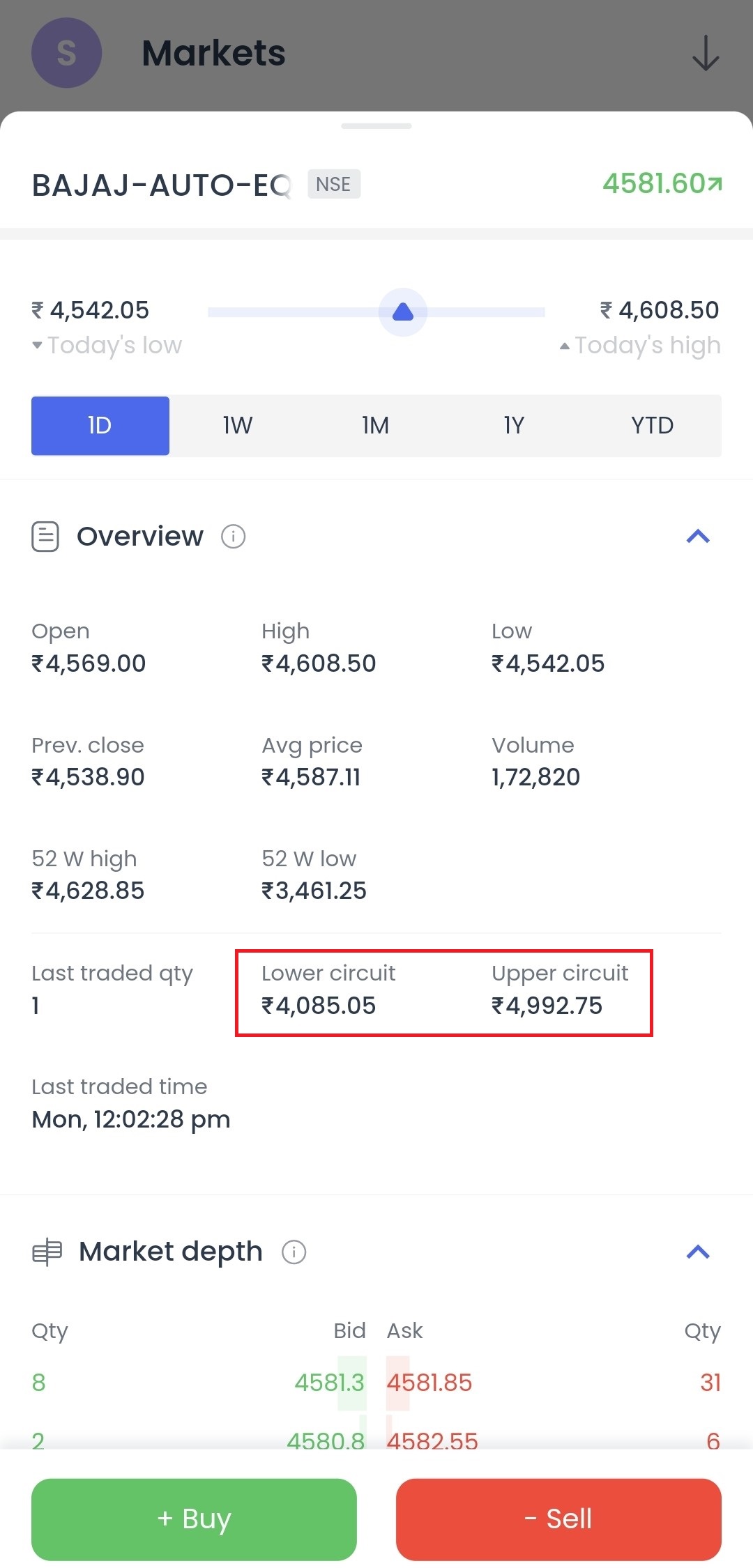

What is a circuit limit?

A circuit limit is a safeguard that restricts how much a stock can move in a given day. The upper and lower circuit limits are pre-determined by the exchange to prevent extreme price movements.

Example:

- Bajaj Auto Ltd. may have an upper circuit limit of ₹4992.75 and a lower limit of ₹4085.05.

- Trading will halt if the stock price breaches these limits.

Possible scenarios when hitting the circuit limit:

Possible scenarios when hitting the circuit limit:

1. For an open Intraday Sell Position hitting the upper circuit:

- No sellers are present, only buyers. You will be unable to buy back the stock, which effectively converts your position to a delivery position for auction settlement.

- Margin Requirement: A 120% margin of the closing price will be blocked.

- Auction Settlements:

- Internal: On T+1 day, using the previous day’s highest bid.

- External: Managed by the exchange on T+1, potentially incurring a penalty of up to 20%.

2. For an open Intraday Buy Position hitting the lower circuit:

- Selling is not possible, and the position converts to delivery. You will need sufficient funds in your account to cover the share delivery to your Demat account.

- Shortfall Scenario: If you don’t have enough funds, you’ll need to either add funds or liquidate other holdings. If you don’t manage the shortfall, FYERS will sell your holdings to cover the shortfall.

Monitor your intraday positions closely and make sure to square them off well before the market closes. This helps you avoid unexpected outcomes when stocks hit circuit limits.

What if...

| Scenario | Outcome |

|---|---|

| Your Intraday sell position hits the upper circuit | No sellers; position converts to delivery for auction settlement |

| Your Intraday buy position hits the lower circuit | Position converts to delivery; you must ensure adequate funds to settle |

| You miss squaring off your position | Position will be squared off by FYERS at 3:15 PM or converted to delivery |

Last updated: 31 Oct 2025

Related Articles

What Happens If My Intraday Short Position or Delivery Obligation Isn’t Settled?

If you sell shares without holding them (short sell) and don’t square off before market close, it may result in short delivery. At FYERS, we handle such settlements strictly as per exchange regulations. The exchange may conduct an auction to source ...What Happens If I Don’t Square Off My Intraday F&O, Currency, or Commodity Positions Before Market Close?

At FYERS, if you don’t manually close your intraday F&O, currency, or commodity positions before the market closes, our Risk Management System (RMS) will automatically take necessary steps to manage overnight exposure and safeguard your account from ...How Does Intraday Futures Trading Work in FYERS?

Intraday futures trading at FYERS lets you open and close futures positions within the same trading day. Leverage depends on exchange-prescribed margins for each contract, and under peak margin rules, intraday and overnight margin requirements are ...How Do the New Delta-Based F&O Ban Rules for Single-Stock Derivatives Affect My Trading on FYERS?

When a stock goes into the F&O ban, the Exchange limits trading based on a delta-based method called Future-Equivalent Open Interest (FutEq OI). In simple words, it checks your total position risk using delta. During the ban, you can only place ...When Will My Bonus, Dividend, or Stock Split Reflect in FYERS?

Corporate actions such as bonus shares, dividends, and stock splits are processed automatically in your FYERS account based on your eligibility on the record date. At FYERS, we handle these updates in coordination with exchanges and the company’s ...